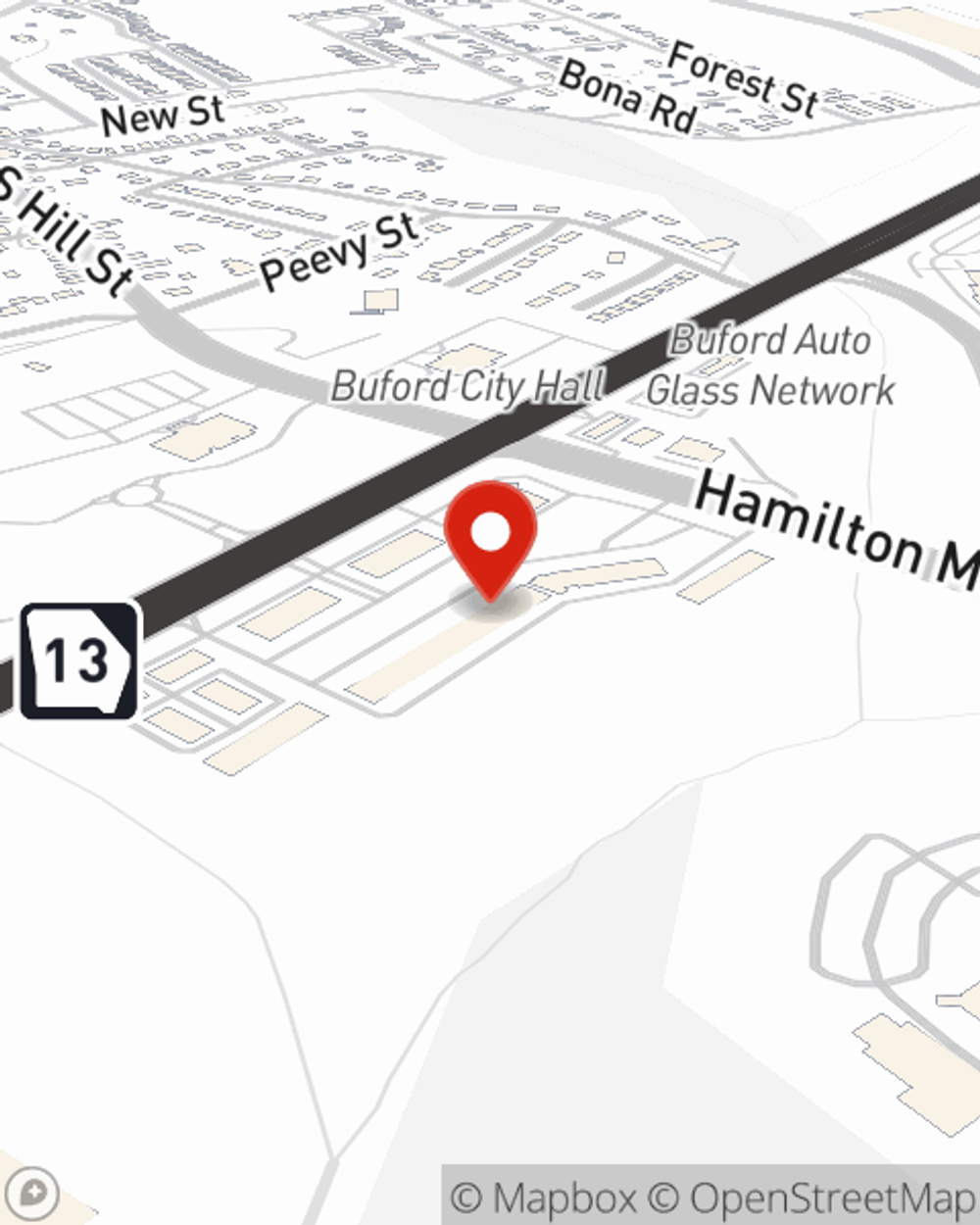

Life Insurance in and around Buford

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

- Buford

- Dacula

- Flowery Branch

- Braselton

- Hoschton

- Suwanee

- Duluth

- Jefferson

- Gainesville

- Sugar Hill

- Lawrenceville

- Alpharetta

- Johns Creek

- Roswell

- Milton

- Cumming

- Hartwell

- Greenville

- Auburn

- Birmingham

- Atlanta

- State of Georgia

- State of Alabama

- State of SC

It's Time To Think Life Insurance

Investing in those you love is a big responsibility. You advise them on important decisions listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Protection for those you care about

Life won't wait. Neither should you.

Buford Chooses Life Insurance From State Farm

You’ll get that and more with State Farm life insurance. State Farm has outstanding protection plans to keep those you love safe with a policy that’s adjusted to fit your specific needs. Thankfully you won’t have to figure that out on your own. With solid values and excellent customer service, State Farm Agent Brian Maloney walks you through every step to develop a policy that protects your loved ones and everything you’ve planned for them.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can prove useful by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Brian Maloney, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Brian at (770) 945-8989 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Brian Maloney

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.